What Type Repairs Can Be Taken For Home Office Deductions

What is the standard deduction?

The standard deduction is a tax write-off that every single American can have. Here's how much information technology's worth equally of 2022:

- For single filers and spouses filing separately: $12,500

- For married filing jointly: $25,100

- For Heads of Household: $eighteen,800

Standard deduction vs. itemizing expenses

When it comes to the standard deduction, you've got a choice. Y'all can either take the $12,000 and change, no questions asked, or you can itemize your personal deductions on your tax return.

It's of import to annotation that these personal itemized deductions have cypher to practice with your deductible business organisation expenses, which you tin claim on top of the standard deduction. More on that later!

Itemized deductions that y'all tin can supercede with the standard deduction include the following:

- 👼Charitable donations

- 🏥 Medical and dental expenses

- 🛒 State and local income taxes or sales taxes

- 🏘️ Real estate taxes

- 💰Personal property taxes

- 💸 Mortgage interest

- 😷 Health insurance premiums (Though health insurance is deductible for self-employed people)

- 🌊 Disaster losses from a federally declared disaster

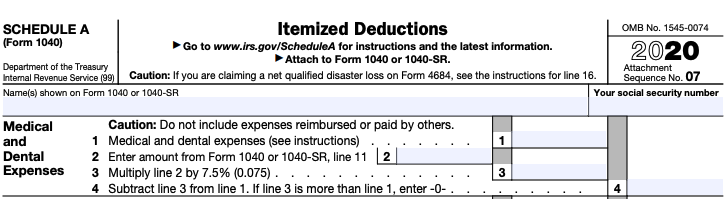

Tax filers who choose to itemize volition indicate the personal deductions they're taking on Schedule A of their taxation return.

Does it make sense to take the standard deduction?

If all the itemized deductions you tin take add upwards to more than your standard deduction amount, and so information technology makes sense to track them separately.

Most people, though, take the standard deduction. (87% of taxpayers opted for information technology in 2022.) It's been especially attractive in contempo years. The Tax Cuts and Jobs Act, for example, near doubled it in 2022.

As a self-employed person, you'll have to brand this conclusion along with every other American tax filer. Your business organisation expenses, though, become in a whole other category.

You can always take those on pinnacle of the standard deduction.

What the standard deduction means for your taxes

If someone who only works Due west-2 jobs makes less than the standard deduction amount, they won't actually be on the hook for income taxes at all. Their taxable income gets reduced to cypher.

Unfortunately, things are different for self-employed people. If you freelance, practice gig work, or run a small business, you'll always have to pay self-employment tax on your 1099 income — even if it'southward much less than the standard deduction.

Hither'south an example. Allow's say you lot earn $50,000 a year. A solid $45,000 of that is from W-ii jobs. Only $v,000 is from a bit of 1099 work you lot do on the side — possibly driving for Uber on the weekends, or occasionally renting out a spare room on Airbnb.

In this scenario, your 1099 income is a lot less than the standard deduction. But you'll still owe effectually $1,500 in taxes on simply that income. (This assumes a standard 30% constructive charge per unit for 1099 income). That's non nothing!

You can come across how this works for yourself using our self-employment taxation rate reckoner. Enter an income from 1099 work — even a pretty low one — and y'all'll see how high the tax charge per unit on information technology goes.

How to write off business expenses on top of the standard deduction

You'll e'er become taxed on your cocky-employment income, even if it'south less than the standard deduction.

That's not exactly happy news. But luckily, it'due south also truthful that you tin always deduct your business expenses — even if yous accept the standard deduction.

Personal vs. business itemized deductions

A lot of freelancers and independent contractors don't realize they can write off business concern expenses if they merits the standard deduction.

Why? Considering it's pretty common to get personal itemized deductions confused with deductible business expenses.

Personal deductions go on your Schedule A, like nosotros talked virtually above. Only itemized concern deductions are something else entirely. These are the purchases yous brand for the sake of your 1099 work.

These go on Schedule C. Just follow the instructions on the class.

Challenge business write-offs on Schedule C

If you're cocky-employed, you'll use Schedule C to study both the earnings from your business and the expenses yous incurred to run it. (This is true whether y'all take a sole proprietorship or a single-member LLC.)

You'll use Schedule C to figure out your internet earnings. (After subtracting your business expenses from your gross income, you'll point whether you had a profit or a loss on line 7a.)

What concern expenses tin can you deduct?

Everything yous spend on your freelance piece of work or small business organisation is tax-deductible on your Schedule C.

If you lot want someone to keep track of your deductible expenses for you lot, give Keeper Taxation a try. Our app automatically scans your transactions for eligible write-offs, so you won't have to practise whatsoever manual expense tracking. You'll too get access to homo bookkeepers who review your write-offs. (They'll fifty-fifty answer your tax questions!)

{upsell_block}

Want to larn more near the write-offs you can take? Check out our intro to revenue enhancement write-offs, or take a look at our job-specific deduction finder. (Whether y'all're a real estate agent or a freelance designer, nosotros've probably got a guide for you!)

In the concurrently, though, here's a list of common business deductions.

🚗 Car expenses

If you drive at all for your 1099 work, you can deduct all your machine-related expenses. From your gas and insurance, to your lease payments and vehicle depreciation, and more than, all these costs are deductible on your taxes.

At that place are two ways to claim car expenses: using the standard mileage charge per unit, or deducting your actual vehicle expenses. If you want to learn more about the pros and cons of each method, cheque out our mail on mileage vs. bodily expenses.

Hither's a full general rule of pollex: if you lot drive a pretty typical amount, you're probably meliorate off deducting actual expenses. If y'all drive a lot for work, though — say, as a rideshare or delivery driver — you'll probable do good from using the standard mileage rate.

{email_capture}

🛫 Travel expenses

If you ever travel for your freelance work, the cost of those concern trips is a deduction for y'all. That goes across obvious travel expenses, like your hotel fees and airplane tickets. You tin besides write off things like laundry fees, Wi-Fi charges, and the meals yous swallow on the go.

To learn more — including what you tin write off and what the IRS rules are for qualifying — check out our guide on business concern travel tax deductions.

🎒Continuing education

Working for yourself means yous need to proceed your skills abrupt. Luckily, courses and study materials related to your field count as taxation-deductible pedagogy expenses.

You don't even need to get a degree or a certificate to write something off as an educational activity expense. Some pretty unusual purchases tin can count — like a concert if yous're a music teacher. To larn more, take a look at our mail on work-related education expenses.

{write_off_block}

🏠 Habitation office expenses

The home office deduction is another popular business expense for self-employed people. This deduction lets you claim a portion of habitation-related expenses, like your hire, utilities, home insurance, and home repairs.

Of course, yous'll only qualify if you lot use at least role of your home for business purposes — to store inventory, meet clients, or really do your work. Want to find out if you can take this deduction? Check out our home office deduction quiz!

There are two ways to write off your abode office expenses. The simplified pick entails multiplying the square footage of your home office by a standard dollar corporeality, upward to 300 foursquare feet. (The electric current charge per unit is $5 per foursquare foot.) Meanwhile, the actual expense method lets you write off what you actually spend on housing.

To find out more, accept a wait at our article on whether you should apply the simplified method.

🏢 Commercial rent

If you lot lease a split workspace for your business, you tin deduct your rent. Just go on in mind: The holding yous rent can't be registered with your proper noun.

Y'all can also claim the hire you pay on any infinite where you lot store inventory.

💻 Computers and software

For nigh freelancers and independent contractors, it's impossible to do any work without a computer. Luckily, your laptop (or desktop) is taxation-deductible.

So is whatsoever software that y'all use on the task. That includes spider web conferencing programs similar Zoom or Microsoft Meets, cloud storage systems, and design tools similar the Adobe Suite.

🛍️ Inventory costs

If you're an online seller, the cost of your inventory will probably be 1 of your biggest expenses. The technical term for this is "toll of goods sold." It'due south 1 of the most pop write-offs in manufacturing and retail.

Here'southward how information technology works. You buy things that are initially categorized as inventory. When that inventory is sold, it'southward converted into your price of goods sold. This lets yous calculate the turn a profit you make on your sales.

👔 Payroll expenses

Does your pocket-sized business have whatever W-2 employees? (If you're running an S corp, this can include yourself!)

If then, you can write off the salaries and wages you pay. If your employees sometimes brand work purchases that you later reimburse them for, you tin can deduct those costs also.

📰 Advertising expenses

You tin deduct all the costs associated with promoting your business organization. From billboard ads to Google ads, all kinds of promotional costs count, whether they're old-schoolhouse or born-digital. Don't forget your website hosting fees!

✉️ Stamp and delivery

Exercise y'all demand shipping and delivery services to practice your work? If so, all your stamp, shipping, and packaging tin can exist deducted.

💵 Tax and licenses

Any license and taxation related expenses for your business are deductible. These can include annual LLC registration fees, state franchise taxes, and payroll taxes.

Unfortunately, though, you can't write off things like traffic tickets and penalties for failing to file your taxes by the borderline.

At Keeper Tax, we're on a mission to aid freelancers overcome the complication of their taxes. That sometimes leads us to generalize tax advice. Please email support@keepertax.com if y'all have questions.

What Type Repairs Can Be Taken For Home Office Deductions,

Source: https://www.keepertax.com/posts/can-i-take-the-standard-deduction-and-deduct-business-expenses

Posted by: trevinopopop1971.blogspot.com

0 Response to "What Type Repairs Can Be Taken For Home Office Deductions"

Post a Comment